Plan Information & Enrollment

Description of Plan Benefits

The Description of Plan Benefits is an excellent educational tool if you are a newly-enrolling participant or just need a refresher. It contains general plan information and contains answers to the most frequently asked questions.

The specific terms of your HRA depend on your employer’s plan design. Generally, reimbursements will be available only after leaving employment, and vesting requirements may apply. Some employer plan designs permit reimbursements during and after leaving employment. You should check with your employer to learn more about the specific terms of your plan.

PARTICIPANTS: After you enroll and you receive a contribution from your employer, we will send you a welcome packet, which will include confirmation of your employer’s initial contribution, your participant account number, a Plan Summary/Summary Plan Description, and online participant account login instructions.

Quarterly participant account statements are generated in January, April, July, and October. If you are signed up for e-communication in lieu of paper (recommended), we will notify you via email when statements are available for online viewing. To sign up for e-communication, log in and click My Profile, or contact our customer care center.

Covered Individuals

Your legal spouse and qualified dependents, including your young-adult children through the calendar year in which they turn age 26, are eligible for coverage. Generally, dependents must satisfy the IRS definition of Qualifying Child or Qualifying Relative as of the end of the calendar year in which expenses were incurred to be eligible for benefits. These requirements are defined by Internal Revenue Code section 105(b). The IRS definitions supersede and may differ from state definitions.

Read our Definition of Dependent handout to learn more. To get a copy, log in and click Resources, or request a copy from our customer care center.

Qualified Expenses & Premiums

Qualified medical care expenses and premiums eligible for reimbursement depend upon your employer’s plan design or certain elections you may make to limit your HRA coverage (read Coordination of Benefits and Premium Tax Credit Eligibility below to learn more about when you may need to limit or permanently waive your HRA coverage). Some employer plan designs limit reimbursements to qualified insurance premiums or certain excepted benefits only.

Common qualified out-of-pocket expenses include deductibles, co-pays, coinsurance, prescription drugs, and certain over-the-counter (OTC) items. Eligible insurance premiums include:

-

Medical (includes marketplace exchange premiums that are not, or will not be, subsidized by the Premium Tax Credit);

-

Dental;

-

Vision;

-

Tax-qualified long-term care (subject to IRS limits; read Tax Qualified Long-term Care Insurance Premium Limits below);

-

Medicare Part B;

-

Medicare Part D; and

-

Medicare supplement plans.

Section 213(d) of the Internal Revenue Code defines qualified expenses and premiums, in part, as “medical care” amounts paid for insurance or “for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body…” Expenses solely for cosmetic reasons generally are not considered expenses for medical care (e.g. face-lifts, hair transplants, hair removal (electrolysis)). Expenses that are merely beneficial to your general health, such as vacations, are not medical care expenses.

Please note the following:

-

IRS regulations provide that insurance premiums paid by an employer, deducted pre-tax through a section 125 cafeteria plan, or subsidized by the Premium Tax Credit are not eligible for reimbursement. If requesting reimbursement of premiums deducted from your paycheck after tax, you must include a letter from your employer that confirms no pre-tax option is available. Qualified insurance premiums deducted from your legal spouse’s paycheck after tax are eligible for reimbursement.

-

If you or your legal spouse has a section 125 healthcare flexible spending account (FSA), you must exhaust the FSA benefits before submitting claims to your HRA.

-

Claims for over-the-counter (OTC) medicines and drugs (except insulin and contact lens solution) must be prescribed by a medical professional or accompanied by a note from a medical practitioner recommending the item or service to treat a specific medical condition. Thus, OTC medicines and drugs such as aspirin, antihistamines, and cough syrup must be prescribed. The prescription requirement applies only to medicines and drugs, not to other types of OTC items such as bandages and crutches.

Read our Qualified Expenses and Premiums handout to learn more. To get a copy, log in and click Resources, or request a copy from our customer care center.

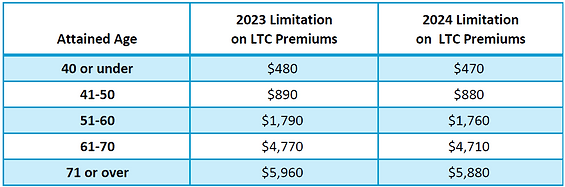

Tax-qualified Long-term Care Insurance Premium Limits

Premiums paid for tax-qualified long-term care insurance are eligible for reimbursement subject to annual IRS limits. The limits are indexed to inflation and are updated annually.

Coordination of Benefits

Read the information below to learn how your HRA coordinates with healthcare flexible spending accounts (FSAs) and health savings accounts (HSAs).

Healthcare FSAs

If you or your spouse has a section 125 healthcare FSA, you must exhaust the FSA benefits before submitting claims to your HRA, which is a health reimbursement arrangement.

HSAs

You can have an HRA and an HSA, and you can use either your HRA, if claims-eligible, or HSA to reimburse your qualified expenses (no ordering rules). But, if you have a claims-eligible HRA and want to become eligible to make or receive contributions to an HSA, you must first elect limited HRA coverage. You can switch your HRA back to full coverage after you stop making or receiving HSA contributions (certain limitations may apply).

To elect limited HRA coverage, submit a Limited HRA Coverage Election form. Forms are available after logging in or upon request from our customer care center.

Only the types of expenses listed below are covered while your limited HRA coverage election is in force. All other expenses incurred while coverage is limited are not covered.

-

Dental care

-

Vision care

-

Preventive care

-

Qualified health insurance premiums for “permitted” coverage (i.e. dental, vision, HSA-qualified high-deductible health plan (HDHP) coverage)

-

Any other permitted benefits as determined by the IRS

Keep in mind that limiting your HRA coverage is not the only HSA contribution eligibility requirement. You should check with your HSA provider, but generally any adult can contribute to an HSA if they (1) have coverage under an HSA-qualified high deductible health plan (HDHP); (2) have no other first-dollar medical coverage (other types of insurance, such as specific injury insurance or accident, disability, dental care, vision care, or long-term care insurance, are permitted); (3) are not enrolled in Medicare; and (4) cannot be claimed as a dependent on someone else's tax return. Your maximum annual HSA contribution amount depends upon your HSA eligibility during the current calendar year. If you become HSA-eligible mid-year, a 12-month testing period may apply to determine your maximum annual HSA contribution.

Premium Tax Credit Eligibility

If you purchase insurance through a marketplace exchange and want to qualify for the Premium Tax Credit, you should (1) read our Facts About Premium Tax Credit Eligibility handout; and (2) consider whether you will need to first use up, limit, or waive your HRA benefits. To get a copy of the Facts About Premium Tax Credit Eligibility handout, log in and click Resources, or request a copy from our customer care center.

Plan Summary/Summary Plan Description

The Plan Summary/Summary Plan Description contains a question & answer section to help you understand and use your HRA, a summary of general plan information, and the following series of important notices:

-

Privacy Notice

-

COBRA Notice

-

USERRA Notice

-

FMLA Notice

-

Medicare Part D Notice of Non-Creditable Coverage

-

Coordination of Benefits with Medicare

-

Exemption from Annual Limit Restrictions

-

Premium Tax Credit Eligibility

A copy of the Plan Summary/Summary Plan Description is provided to all newly-enrolling participants with their welcome packets. To get a current copy, log in and click Resources, or request a copy from our customer care center.

Summary of Benefits and Coverage

As a participant in the HealthSecure HRA Plan, the benefits available to you under the Plan, as well as any limitations, are important. To help you understand the types of benefits provided by the Plan and any applicable limitations, the Plan makes available a Summary of Benefits and Coverage (SBC), which summarizes important information about your benefits. Please note that the format and content in the SBC is required by federal regulation and is designed to apply to health insurance plans. Your HRA is not a health insurance plan. Therefore, the SBC indicates that some of the information and defined terms are not applicable to your HRA. To get a copy of the SBC, log in and click Resources, or request a copy from our customer care center.